Note: all numbers relate to continuing operations unless otherwise stated

- Q1 revenue -4.9%; LFL1 revenue -3.8%

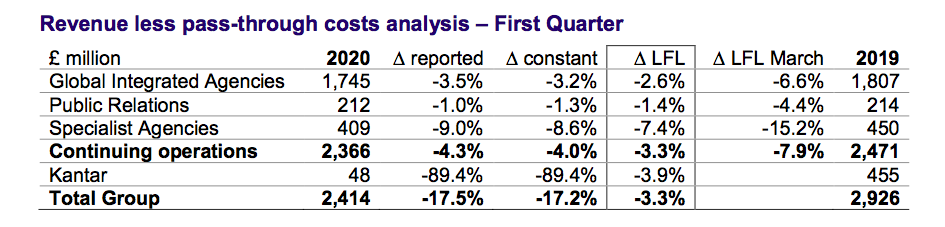

- Q1 LFL revenue less pass-through costs -3.3%, with the impact of COVID-19, felt more strongly in March, at -7.9%, as expected

- Top five markets Q1 LFL revenue less pass-through costs: US -1.9% (March -3.7%);UK -4.2% (March -9.8%); Germany -4.3% (March -14.9%); Greater China -21.3%(March -29.9%); India 6.1% (March -1.1%)

- China: offices back to around 90% occupancy, rapid recovery in economic activity

- Encouraging net new business performance: $1 billion won in the first quarter

- Strong liquidity and balance sheet: average net debt £2.1 billion, down £2.1 billion-year-on-year, with £4.4 billion of cash and undrawn facilities

- Substantial actions are already taken to manage cash flow and profitability include suspension of the 2019 final dividend and share buyback program, reductions in costs and capital expenditure, and tight controls on working capital

- Further measures on costs now being implemented: voluntary salary sacrifice from over 3,000 senior roles, part-time working, and some permanent headcount reductions

- Plans in place to flex costs against a range of economic scenarios to ensure cash flow and profit are managed and the business can respond quickly when markets recover

Mark Read, Chief Executive Officer of WPP, said, “After a good start to the year, with growth outside of China in January and February, our business started to be materially impacted by COVID-19 in March. Our response has focused on four areas: the health of our people, serving our clients, helping to mitigate the impact of the virus on our communities, and ensuring WPP is financially strong.”

“Close to 95% of our 107,000 people are working from home, providing uninterrupted service to clients, helping them to communicate their own actions, sustain their brands and develop new ways to market their products. We have also won $1 billion of new business in the first quarter, including the global integrated Intel account, creative duties for Discover and the media accounts for Hasbro and Novo Nordisk”, he added.

“We have witnessed a decade’s innovation in a few short weeks, with the way people meet, shop, work, and learn increasingly reliant on technology. We are seeing clients rapidly shift emphasis and budget into digital media and direct-to-consumer channels and continue marketing technology investments. And, while many clients are significantly impacted by a reduction in consumer demand, other sectors such as packaged goods, technology, and food retail brands have been more resilient. As in previous downturns, those who are most prepared and most far-sighted will be at an advantage when we come through the current situation”, said Read.

He further shared, “At a time of great uncertainty, I am very proud of how our people and clients have responded. Despite the economic challenges that will, no doubt, be with us for some time, the way we have come together gives us real confidence in our future.”

COVID-19 business update

People

The health of the people remains the company’s first priority. In the middle of March, they asked their people to work remotely and now have almost 95% of 107,000 employees are working from home, with the exception of teams in China who have largely returned to the office. Leadership across WPP and its agencies are communicating frequently with their teams, mainly by video conference.

Clients

WPP’s clients have been able to depend on them for uninterrupted service from the outset. While sectors such as Automotive, Travel & Leisure and Luxury & Premium, which together account for 24% of the top 200 clients’ spend, the company has seen the most significant cuts, spend is holding up relatively well in sectors such as Consumer Packaged Goods, Technology and Healthcare & Pharma, which together represent 54%.

In some cases, there was a greater demand for public relations, e-commerce, marketing technology, and production capabilities. Clients continue with new business reviews and WPP has registered a number of important wins including Discover, Hasbro, Intel, and Novo Nordisk, as well as retentions including BBVA. While it is estimated that some 20% of pitches have been put on hold, those that had started are continuing (though clients are understandably reluctant to begin new reviews). So far this year WPP has not lost a significant account from any client.

Communities

The conglomerate is working with clients, governments, national health organizations, and NGOs to help limit the impact of COVID-19 on society. A team of WPP agencies, for example, is supporting the World Health Organization on a pro bono basis by delivering global and regional public awareness campaigns to encourage people to stay at home and adopt safe behaviors. The partnership involves WPP agencies including Grey, GroupM, Hill+Knowlton, Hogarth, Inca, Motion Content Group, Ogilvy, Wavemaker, and WPP Scangroup, as well as Kantar.

Financial resilience

On 31 March, WPP outlined a number of measures designed to strengthen the Company’s financial position, including steps to reduce costs and conserve cash, and more.

The current situation is unprecedented and the immediate future highly uncertain. There are some positive signs. Visibility of a return to normal remains low, but a number of clients are seeking the agency’s advice and support on how they should market their brands in the recovery phase.

First Quarter Group performance

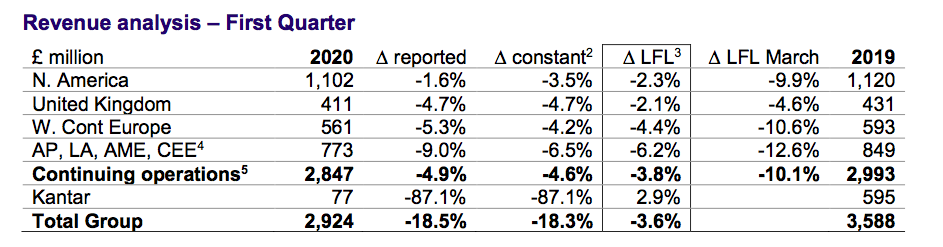

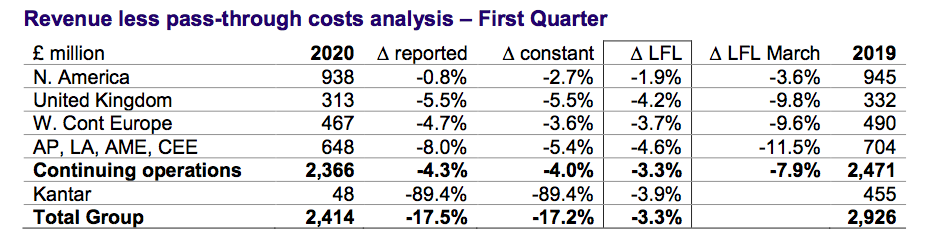

Revenue from continuing operations in the first quarter of 2020 was £2.8 billion, -4.9% compared with the same period last year on a reported basis and -4.6% on a constant currency basis. LFL revenue was -3.8% compared with last year. Revenue less pass-through costs were £2.4 billion, -4.3% on a reported basis, -4.0% in constant currency, and – 3.3% LFL.

In March, LFL revenue less pass-through costs were -7.9% as the impact of COVID-19 began to be felt more widely across our business.

Regional review

Revenue analysis – First Quarter

North America, with LFL revenue less pass-through costs -1.9%, was the best performing region in the first quarter, showing a further improvement in trend over the second half of 2019. This reflects the lapping of some significant assignment losses from 2018 and improved new business performance in 2019. VMLY&R, Grey, and GroupM all grew in the region during the period. March showed a slight deterioration in trend, as expected.

In the United Kingdom, LFL revenue less pass-through costs were -4.2%, with March -9.8% as the impact of the lockdown began to have an effect on client spend.

Western Continental Europe saw LFL revenue less pass-through costs of -3.7%. Performance varied significantly from market to market, with countries such as Spain and Denmark continuing to trade relatively well despite widespread lockdowns, and other markets such as Italy showing a marked deterioration in performance during March.

In the Asia Pacific, Latin America, Africa & the Middle East and Central & Eastern Europe LFL revenue less pass-through costs were -4.6%. Asia Pacific was the weakest sub-region, reflecting the COVID-19 impact on Greater China, but Africa & the Middle East grew strongly and Central & Eastern Europe was also up year-on-year.

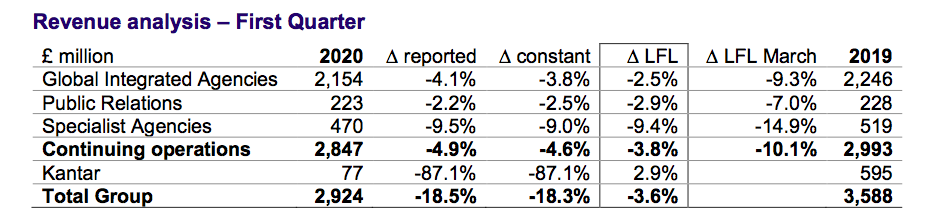

Revenue analysis – First Quarter

In Global Integrated Agencies, LFL revenue less pass-through costs were -2.6%. VMLY&R performed strongly, achieving good growth in the first quarter. All of the other agencies recorded declines, although Wunderman Thompson and Grey had been showing encouraging sequential improvement until March.

Public Relations LFL revenue less pass-through costs were -1.4%, with the decline mitigated by strong demand for some of our Specialist PR services in the current environment.

Specialist Agencies LFL revenue less pass-through costs were -7.4%, with the overall performance continuing to be impacted by a significant client assignment loss in late 2018. Geometry and our Brand Consulting businesses also declined year-on-year, with the latter impacted by the project-based nature of much of their work.

Within WPP’s top 200 clients, 54% of revenue less pass-through costs came from the Consumer Packaged Goods, Technology, and Healthcare & Pharma sectors, which are yet to see a significant impact and were up 4.9% LFL in the first quarter. 22% of revenue less pass-through costs came from sectors including Telecoms, Media & Entertainment, Retail, and Financial Services, which were up 4.0% and have seen a mixed impact. The remaining 24% of revenue less pass-through costs came from clients in the more affected sectors of Automotive, Luxury & Premium, and Travel & Leisure, with -4.0% LFL in the first quarter and -9.5% in March.

Update on cost reduction measures

As announced on 31 March 2020, WPP has already taken a number of actions to reduce the cost to protect profitability, where possible, from a decline in revenue less pass-through costs. These include: freezing new hires; reviewing freelance expenditure; stopping discretionary costs, including travel and hotels and the costs of award shows; and postponing planned salary increases for 2020. In addition, members of the WPP executive committee, as well as the Board, have committed to taking a 20% reduction in their salaries or fees for an initial period of three months. We anticipate these actions will generate total in-year savings for 2020 of £700-800 million.

More recently, additional measures include voluntary salary sacrifice and part-time working. Over 3,000 people with salaries above certain levels have already committed to giving up 10-20% of their salary for an initial three-month period.

WPP has a strong balance sheet and good liquidity. Over the last two years, the group has raised approximately £3.2 billion from their disposals program, selling 50 businesses and investments.

As previously communicated, to preserve liquidity the Board has decided to suspend the share buyback program and the 2019 final dividend. These two actions together will preserve approximately £1.1 billion of cash. The Board will continue to review the status of both the share buyback and the 2019 dividend.

WPP has identified capital expenditure savings in excess of £100 million in property and IT against an initial 2020 budget of around £400 million.

Financial guidance

As announced on 31 March 2020, WPP has withdrawn guidance for the 2020 financial year. It is not possible to quantify the depth or duration of the impact but WPP is nonetheless confident that, through their scenario planning, they are well-positioned to take further action if the downturn is prolonged and to respond positively when the market picks up.

Comments

comments