Kantar today identified children as the most important influencers in making our daily household shopping habits more environmentally responsible. Who Cares, Who Does, a new sustainability study from Kantar, finds that almost half of households (49%) say the COVID-19 pandemic has made sustainability even more important to them. The percentage of ‘Eco-active’ households has grown from 16% in 2019 to 22% in 2021. Family, mostly children, were identified as the biggest influence (36% of respondents) after the product packaging, in shifting habits according to the global study.

The Who Cares Who Does study segments households into three categories based on their actual behaviors:

- Eco-actives (22% of households): Shoppers who are highly concerned about the environment and are making the most of actions to reduce their waste.

- Eco-considerers (40% of households): Shoppers worried about the environment and plastic waste but are not taking many actions to reduce their waste.

- Eco-dismissers (38% of households): Shoppers who have little or no interest in the environment and are making no steps to reduce waste.

The study, in its third year, found that the Eco-active segment has grown six percentage points over the past two years, to account for 22% of global households. Kantar projects this segment will grow to 40% of all households over the next five years, and more than half of households by 2029. Kantar estimates FMCG/CPG shopping by Eco-actives will total $446 billion in 2021, up to $70 billion vs 2020, and forecasts this segment will grow to $925 billion by 2026 – a CAGR of 15.7%, more than five times faster than the grocery market as a whole.

Who is the Greenest?

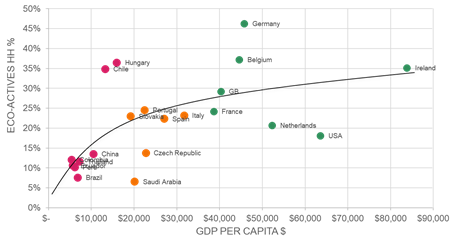

Germany has the largest Eco-actives segment – accounting for 46% of households in 2021, followed by Belgium and Hungary. At just 7% of households, Saudi Arabia is the country with the lowest penetration of eco-actives. There is a direct correlation between GDP per household and the prevalence of eco-active households (see chart 1). Of the more economically advanced countries, the Netherlands and the United States have the lowest incidence of Eco-actives.

Chart 1: Most developed countries have a higher share of eco-activities

Chart 1: Most developed countries have a higher share of eco-activities

Kantar also asked consumers to identify their major sustainability concerns and their major barriers to acting sustainably. Table 1 shows the top concerns and barriers.

| Top environmental concerns | Top Barriers to sustainable behavior |

| Climate change (42%, +2% Vs 2020) | Products are harder to find or more expensive (59%) |

| Water pollution (36%, +1% vs 2020) | Being distracted while shopping (33% ) |

| Plastic waste (34%, -3% vs 2020) | Uncertainty over what action to take (22%) |

Table1: Environmental concerns and barriers

With many brands already focusing on their sustainability credentials, consumers already have a perspective on which brands do a lot for society. The top 10 brands recognized by consumers for their environmental and societal impact are illustrated in table 2 below.

| For environment | For society | |

| 1 | Nestlé | Avon |

| 2 | Coca-Cola | Tony’s Chocolonely* |

| 3 | Natura* | Natura* |

| 4 | Almarai | Nestlé |

| 5 | Ecover* | Nivea |

| 6 | Yves Rocher* | Oriflame* |

| 7 | Nivea | Body shop* |

| 8 | Tony’s Chocolonely* | Yves Rocher* |

| 9 | Zywiec Zdrój | Lush* |

| 10 | Frosch* | Dove |

Table 2: *= Sustainability as a core value proposition

Discussing the findings Guillaume Bacuvier, CEO of Kantar’s Worldpanel division, commented “Eco-actives are driving growth for brands that embrace sustainable strategies. As a segment, the eco-active market will grow five times faster than the overall grocery market, so building a competitive advantage through your sustainability strategy represents a major opportunity for brands. Companies that get it right will reap the rewards, those that fail to act risk turning away a growing number of shoppers. Two-thirds of all shoppers have stopped purchasing a product or service which has a negative impact on the environment at least once.

For retailers, there is much more to do. Only 44% of shoppers are somewhat or very satisfied with the in-store offering. A good choice of local products and affordable options are the most important sustainability factors shoppers consider when choosing a store for their shopping. Fewer people are looking for a specific sustainable section.”

The Who Cares, Who Does study interviewed almost 90,000 respondents in 26 countries and is accompanied by a free webinar summarising the findings.

Comments

comments